Madrileña Red de Gas has shown great adaptation and financial resilience with respect to the convulsive scenario experienced during 2022, in which price volatility and uncertainty have marked the first half of the year. We closed the year with 908,984 supply points, of which 900,911 are natural gas and 8,073 LPG.

In 2022, we have invested 14 million euros in extending our distribution network, facilitating access to natural gas for many homes, businesses and large consumers such as hospitals and schools, and especially for industry.

This is the second year of the regulatory period (2021-2026), in which gas years are set that differ from the calendar year.

Results Summary

| Profit and losses (€M) | 2021 | 2022 | 1 Excluding non-recurring expenses. |

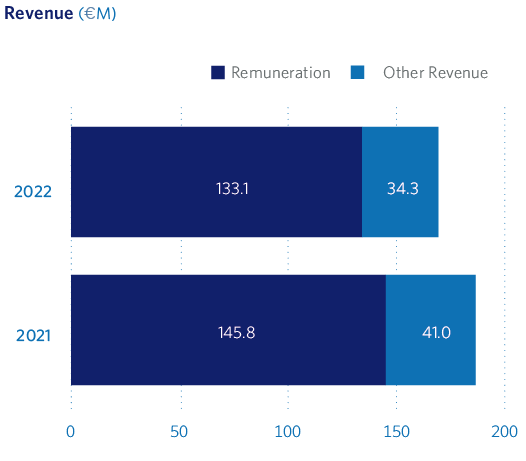

| Remuneration | 145.8 | 133.1 |

| Other revenues | 41.0 | 34.3 |

| EBITDA1 | 141.3 | 130.4 |

| EBIT | 106.7 | 97.2 |

| Net profit | 70.3 | 90.1 |

The year 2022 was characterized by the conflict between Ukraine and Russia and by high volatility and uncertainty in the markets. In this context, MRG continues to demonstrate its ability to maintain stability in the face of adverse economic cycles and unexpected events, obtaining excellent results that confirm great financial resilience, as well as solidity and predictability in the generation of income.

Total revenues in 2022 were 167.4 million euros, 10% lower than the previous year, mainly due to lower gas demand due to higher temperatures and regulatory curtailment.

MRG’s main activity, the distribution of natural gas, is a regulated activity, the regulatory periods of which cover 6 years. The year 2022 was the second year of the regulatory period 2021-2026, where the gas year closed on 30 September.

The growth strategy remains focused on profitable and sustainable expansion in our territory and adjacent territories.

The company continues to increase its customer base, achieving in 2022 the same growth rate as in the years prior to the pandemic. At the end of 2022, Madrileña Red de Gas distributes gas to 908,984 supply points, of which 900,911 are natural gas and 8,073 LPG.

Other pillars underpinning the growth strategy are the commitment to the decarbonization process and the replacement of more polluting and less efficient energies, the promotion of the use of natural gas vehicles, robotization, digitalization and automation of processes, the focus on customer satisfaction and renewable gases, including green hydrogen.

Operational results

EBITDA in 2022 was €130.4 million, 8% lower than in 2021, mainly due, as discussed above, to lower revenues recorded due to lower gas demand due to higher temperatures and also due to the regulatory curtailment.

Revenue

Total revenue in 2022 was EUR 167.4 million (EUR 186.8 million in 2021), of which EUR 156.4 million came from the natural gas business, while the remaining EUR 11 million originated from the LPG business.

Within the natural gas business, 85% was contributed by the regulated remuneration for the distribution activity, comprising the figure set by the Resolution of 20 May 2021 and 19 May 2022 of the National Markets and Competition Commission, as well as management’s best estimate of remuneration.

The remaining 15% relates to other services related to the natural gas distribution activity, such as meter rental, periodic inspections and other services to consumers.

Financial position and balance sheet

Financial strength is an essential pillar of MRG’s strategy. The company has strong solvency and liquidity levels consistent with investment grade. The financial structure is efficient and long-term.

In 2022, the gross debt amounts to EUR 226.8 million and has an average maturity of 5 years.

The company also has a contingent credit line of 75 million euros, renewed in February 2022, until February 2025, in line with the company’s real needs for the coming years.

Flexibility in the dividend policy is another key feature that gives the company a better financial position.

The group’s debt is issued by MRG Finance, B.V. on the Luxembourg regulated market under an EMTN program.

This debt is rated investment grade (BBB-) by Standard and Poor’s and BBB (low) by the rating agency DBRS

| Balance sheet (€M) | 2021 | 2022 |

| Gas distribution licences & other intangibles | 751.0 | 751.0 |

| Net tangible fixed assets | 318.1 | 294.9 |

| Total network fixed assets | 1,069.1 | 1,045.9 |

| Goodwill | 57.4 | 57.4 |

| Deferred tax assets | 14.7 | 12.4 |

| Other non-current assets | 339.2 | 7.8 |

| Current assets | 34.5 | 35.5 |

| Cash | 33.5 | 16.2 |

| Total assets | 1,548.4 | 1,175.2 |

| Equity | 432.8 | 752.8 |

| Long term debt | 944.6 | 1.8 |

| Deferred income tax liabilities | 79.9 | 92.0 |

| Other non-current liabilities | 36.1 | 200.2 |

| Current liabilities | 54.9 | 68.4 |

| Total liabilities & shareholders equity | 1,548.4 | 1,175.2 |

Operations Cash Flow

than the previous year. The variations in the balance sheet balances of the gas system for 2022 compared to 2021, together with the greater investment made, mainly explain this variation.

The year 2021 was characterized by a system surplus position as of December 31, which, compared to the system deficit position for the same period in 2022, explains the variation of 20.3 million euros in cash flow.

The greater investment in 2022 compared to 2021 is the result of the acceleration of the conversion plan for LPG supply points to natural gas.

| Free cash flow (€M) | 2021 | 2022 |

| EBITDA | 141.3 | 130.4 |

| Income tax paid | (5.6) | (5.2) |

| Working capital | 3.4 | (11.4) |

| Capex | (13.1) | (17.6) |

| Free cash flow | 126.0 | 96.2 |

Investments

total of €17.6 million, representing 34% more than the previous year, as a result of a greater investment made in the transformation of LPG supply points to Natural Gas. Based on their nature, the following groups can be classified:

Expansion

MRG has invested a total of €14 million, of which 10 million euros have been allocated to the expansion of the natural gas distribution network and €4 million have been allocated to the transformation plan from LPG to natural gas.

Other projects

Investments remain at a level similar to the previous year, directed towards network maintenance, fraud prevention, digitization and development of information systems with the aim of obtaining cost efficiency and improving the quality of Customer Support.

| Capex Investments (€M) | 2021 | 2022 |

| Expansion | 8.1 | 14.0 |

| Others | 3.4 | 3.6 |

| Non-recurring | 1.6 | 0 |

| Total | 13.1 | 17.6 |